Whether you buy new or used, it's wise to get pre-approved for a loan before you ever step on a car lot. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and provide you with an amount and interest rate.

The higher the score the lower the interest rate you will be offered. People with a bad credit history may pay interest rates that are more than double prime rates. You can also shop for auto loans online if you aren't concerned about where your personal information goes. Armed with a pre-approved loan you are now in control and have a choice to go with dealer financing or stick with your bank, whichever rate is lower.

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehicle—let's say $8,000 to $10,000—is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. Understanding the true cost of a car loan is especially important now that average loan terms have been growing, according to credit reporting agency Experian.

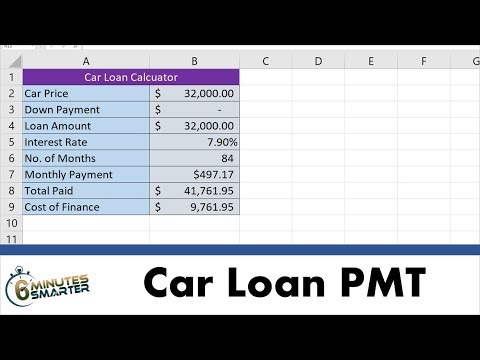

In the fourth quarter of 2019, the average loan term on new cars purchased was just over 69 months. Use our auto loan calculator below to find your monthly payment, your total interest charges and your car's overall cost. There are a lot of benefits to paying with cash for a car purchase, but that doesn't mean everyone should do it.

Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. It is up to each individual to determine which the right decision is. The car loan calculator is a tool that does more than just show you a monthly car loan payment.

Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation. To know exactly how much you'll be paying each month, you need to determine the cost of the vehicle, the loan term and the interest rate.

Use this auto loan calculator to determine the monthly payment for the new car or truck you've had your eye on. APRs appearing in rate tables and/or calculator results are based on your input and are subject to change at any time. Additional terms and conditions apply such as vehicle age and mileage. Consider checking your credit report occasionally to be sure inaccuracies aren't impacting your ability to receive credit. Calculator results are also based on your selected dealer state, loan-to-value ratio of 100% and only apply to car purchases from a dealer in the Chase network. Your loan term -- or the amount of time you'll be paying back the loan -- will impact the price of your monthly car payments.

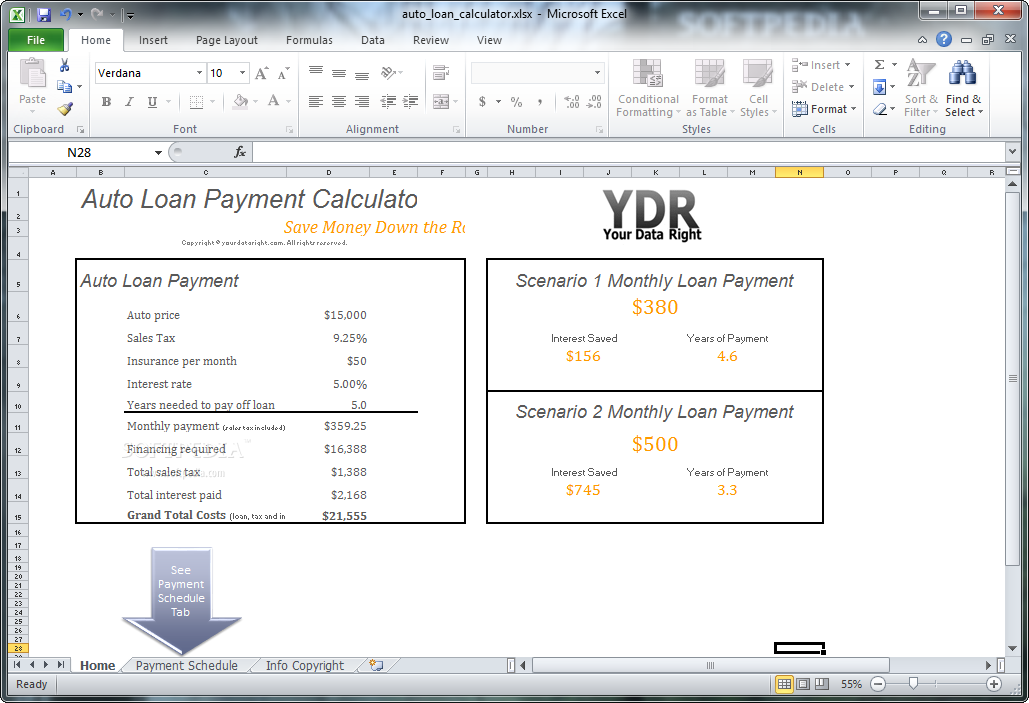

With a shorter-term auto loan, your monthly payments will be higher, but you will have a lower APR and pay less in interest in the long-run. Use the auto loan calculator to see the difference in monthly payments and interest paid depending on the term of the auto loan. Bankrate's auto loan calculator will give you a good idea of how much car you can afford from a monthly payment standpoint. Start with a list of vehicles that you're interested in and estimated purchase prices. Then subtract the amount of money you can use for a down payment and an estimate of your current car's trade-in value. Lastly, compare costs to make sure that the calculated auto loan payment based on the amount you need to borrow aligns with your monthly budget.

Use this calculator to help you determine your monthly car loan payment or your car purchase price. Experts suggest that you should not allocate more than 20% of your take-home pay towards monthly auto payments. The down payment, interest rate and term of your loan will also determine how much you can afford to buy. Many times dealerships will offer a choice of 0% financing or a factory rebate. Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing.

For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some "buy here, pay here" dealerships specifically focus on subprime borrowers. The best way to lower your vehicle payment is to put money down when you initiate the deal.

For example, if you're buying a $20,000 vehicle, your auto loan would be for $20,000, plus whatever the interest is. But with a $4000 down payment, you'll only have to take out a $16,000 loan, plus interest. The benefit here, aside from a lower sale price, is that you will have lower monthly payments. Try using different down payments in the car loan calculator Canada!

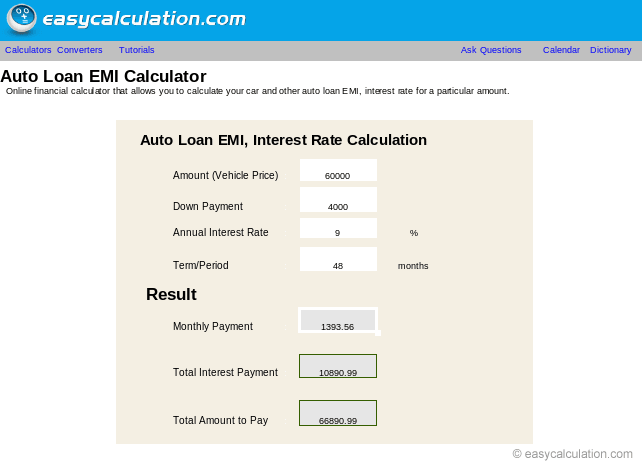

Use our auto loan calculator to estimate your monthly car loan payments. Enter a car price and adjust other factors as needed to see how changes affect your estimated payment. All you need to do is add in your original loan balance, your loan term, the interest rate, how much you would like your extra monthly payment to be and the number of payments made. From there, the car loan calculator with extra payments will calculate how much you would normally have to pay versus the adjusted monthly amount. Now you can compare side by side your current payment to your early payoff amount. Several types of lenders make auto loans, including car dealers, major national banks, community banks, credit unions and online lenders.

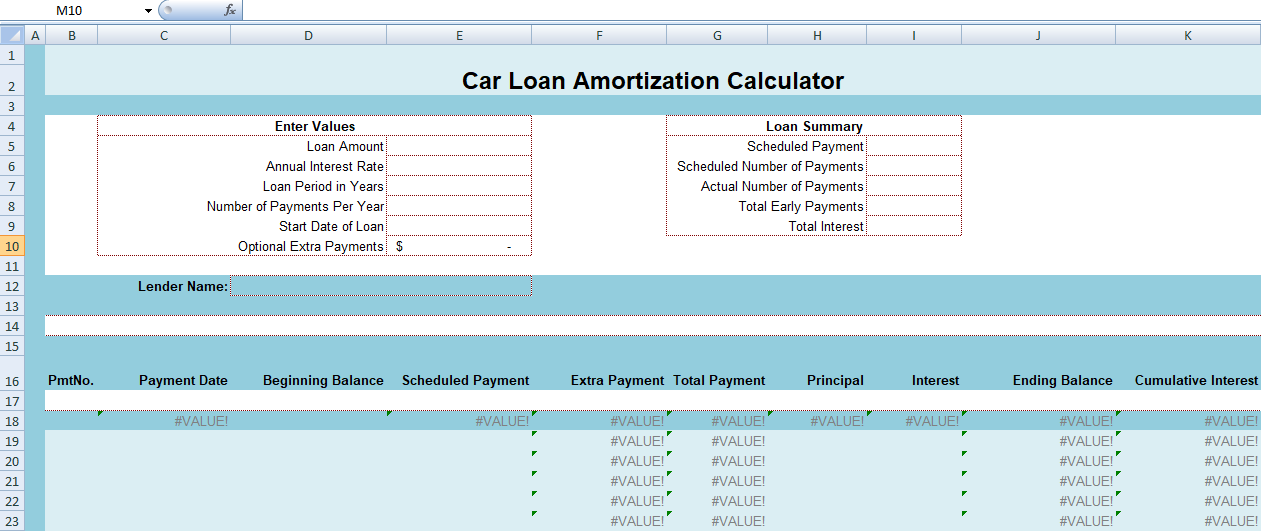

You may get a particularly good deal from a lender you already have an account with, so check their rates first. Compare auto loan rates across multiple lenders to ensure you get the lowest APR possible. An auto loan calculator shows the total amount of interest you'll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you'll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

Use our auto loan calculator to be sure you're making the best financial decision. Your monthly auto loan payment is based on the net purchase price of the vehicle, the loan term and the interest rate for the loan. The loan amount is based on the net purchase price of the vehicle or the vehicle price less any cash rebate, trade-in or down payment. If you have an outstanding balance on the vehicle you trade-in, that amount is added to the price of the vehicle you are purchasing. The factor that will change your monthly payment the most is the loan term. The longer your loan, the less you'll pay each month, because you're spreading out the loan amount over a greater number of months.

However, due to the interest you'll be paying on your loan, you'll actually end up spending more for your vehicle by the time your payments are over. Because the more time you spend paying off your loan, the more times you will be charged interest. They work as any generic, secured loan from a financial institution does with a typical term of 36, 60, 72, or 84 months in the U.S.

Each month, repayment of principal and interest must be made from borrowers to auto loan lenders. Money borrowed from a lender that isn't paid back can result in the car being legally repossessed. Many variables, including current market conditions, your credit history and down payment will affect your monthly payment and other terms. See your local dealer for actual pricing, annual percentage rate , monthly payment and other terms and special offers. Pricing and terms of any finance or lease transaction will be agreed upon by you and your dealer. Buying any new or used car can get overwhelming when you have no clue of where to begin from the money standpoint.

One of the keys to a successful car purchase has always been being able to figure out what you can manage financially. So, to that end, use our car loan calculator to get an idea of what you can afford! All you have to do is plug in your desired monthly payment or your desired vehicle price. The auto loan calculator will display your estimated monthly auto payment.

You will also see the total principal paid and the total interest paid. Add these two figures together to see the total amount you will pay for your new or used car over the life of the loan. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other factors. If you're planning on financing your new vehicle purchase, the overall price of the vehicle isn't really the number you need to pay attention to.

Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal. Improving your credit score or applying with a co-applicant are two ways to improve your chances of loan approval and, if approved, getting a lower rate. Now that you know exactly how much your monthly car loan payment will be after factoring in the fee, interest, and trade- allowance, it's time to budget for your payment. Your first step is to analyze your overall financial situation by taking a deeper look at how and where you spend your money on both a monthly and daily basis. Use ACCC's Budget in Your Pocket worksheet to help you figure out where your money is going on a day-to-day basis.

To get an overall sense of your expenses on a monthly basis, use ACCC's Household Budgeting worksheet. Be sure to include your estimated car loan payment you just calculated. The Auto Loan Calculator is mainly intended for car purchases within the U.S. People outside the U.S. may still use the calculator, but please adjust accordingly.

If only the monthly payment for any auto loan is given, use the Monthly Payments tab to calculate the actual vehicle purchase price and other auto loan information. Annual percentage rate is the cost you pay each year for financing - it includes finance charges, fees, and other charges. Because financial institutions use credit scores to make sure you're able to repay a debt, creditors usually check your credit before quoting you an APR. The better the credit score, the more favorable APR you may receive. Enter the amount you need to finance your car into the auto loan calculator. To calculate this, subtract your down payment and trade-in value amounts from your car's sticker price or MSRP.

A new car comes with new costs to consider like gas and maintenance, but the most important one to account for is a new car loan payment. Flagstar Bank's car loan payment calculator takes your vehicle data, trade-in information, and loan costs to create a personalized loan payoff schedule. Never worry about how to calculate monthly car payments ever again. Avoid stretching out your loan term to keep your auto loan payment as low as possible. You'll not only pay more in interest; you may also end up having negative equity, meaning you owe more on the car than it's worth, for an extended period of time.

Choose the shortest loan term you can manage while balancing other expenses like housing, savings and repaying other debts. Know that there isn't one "best" way to get the lowest monthly payment. It depends on your trade-in value, your credit history, your desired term, how much your willing to put down at the time of purchase, etc.

If you're on a tighter budget, then choosing the lowest payment possible could be the best way to go. However, if you're able to pay more each month, then you'll be able to take a shorter term and have your vehicle paid off faster . Credit, and to a lesser extent, income, generally determines approval for auto loans, whether through dealership financing or direct lending. In addition, borrowers with excellent credit will most likely receive lower interest rates, which will result in paying less for a car overall. Borrowers can improve their chances to negotiate the best deals by taking steps towards achieving better credit scores before taking out a loan to purchase a car. A car purchase comes with costs other than the purchase price, the majority of which are fees that can normally be rolled into the financing of the auto loan or paid upfront.

However, car buyers with low credit scores might be forced into paying fees upfront. The following is a list of common fees associated with car purchases in the U.S. Use this calculator to help you determine the monthly loan payment for your car, truck, boat, RV or motorcycle. Enter purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down payments can impact your monthly payment. Use our car loan calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan.

If pre-qualified for a loan, your pre-qualification is good for 30 days. You'll have time to shop for the vehicle that meets your needs, as well as your budget. Pre-approval or pre-qualification for a car loan makes you a more competitive buyer when you walk into a dealership. You'll be able to focus more on the cost of your new car rather than negotiating a monthly payment with a dealer. Adjust the loan amount and loan term length on the loan payment calculator to see how it impacts your monthly payments.

Auto loans have a minimum loan term of 12 months and minimum loan amount of $5,000. Avoid Overbuying—Paying in full with a single amount will limit car buyers to what is within their immediate, calculated budget. To complicate matters, car salesmen tend to use tactics such as fees and intricate financing in order to get buyers to buy out of their realm.

If the fees are bundled into the auto loan, remember to check the box 'Include All Fees in Loan' in the calculator. Should an auto dealer package any mysterious special charges into a car purchase, it would be wise to demand justification and thorough explanations for their inclusion. As a business, a car loan may help you improve cash flow to your business as well as the potential to claim tax deductions if the car is being used for business purposes .

In addition to looking at the monthly car payment result, be sure to consider the total amount you'll spend on the car loan. If you're using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost. One of the main factors lenders consider when you apply for a loan is your credit score.

A higher score can help you secure a better interest rate—which means you'll have a lower monthly car payment. The total amount you wish to finance for your auto loan (for example, the price of the car plus taxes and fees and minus any down payment or trade-in value). Bank of America auto loans range from a minimum of $7,500 ($8,000 in MN) to a maximum of $100,000.