Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time.

In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution.

Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Your mobile carrier's message and data rates may apply. Joint checking accounts are an effective way for couples, parents and children, and business partners to manage money together, and the one you pick will depend on your circumstances. Make sure you look at all the features including interest rates, fees, ATM access, parental controls, minimum balance requirements before selecting an account. Cross-selling, the practice underpinning the fraud, is the concept of attempting to sell multiple products to consumers.

For instance, a customer with a checking account might be encouraged to take out a mortgage, or set up credit card or online banking account. Success by retail banks was measured in part by the average number of products held by a customer, and Wells Fargo was long considered the most successful cross-seller. Richard Kovacevich, the former CEO of Norwest Corporation and, later, Wells Fargo, allegedly invented the strategy while at Norwest.

Under Kovacevich, Norwest encouraged branch employees to sell at least eight products, in an initiative known as "Going for Gr-Eight". Average daily balance means the ending ledger balance in the account each day, divided by the number of the days in the month. You must maintain the minimum average daily balance for the monthly cycle.

The person listed first on the account must maintain the balances shown. Qualifying deposit accounts include personal checking, savings, money market and CDs. Combined balances are determined by using the actual balance on the day prior to the checking account statement cycle date each month.

The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts.

The account even comes with the option to write checks. Banks charge monthly checking account maintenance fees that vary, from as little as $6 to as much as $15 per month, to account holders who don't meet minimum balance or monthly deposit requirements. We looked at the fees charged by 10 banks across 16 no interest checking accounts and 15 high yield checking accounts.

Almost all of these banks charge monthly maintenance fees for checking accounts, but in most cases, these fees can be waived if certain conditions are met. These conditions typically require a minimum daily or average balance or a monthly direct deposit of a specific amount. Some of the accounts listed below are only available in specific states. If you overdraw your account, Capital One offers the ability to opt-in to Next Day Grace, which allows the bank to authorize transactions that exceed the balance in your account. You'll have until the end of the next business day to make your balance positive, or you'll incur a $35 fee.

Any bounced paper checks will incur a $9 fee, regardless of overdraft coverage. To earn the high rate in any given month, you have to make 15 or more debit card transactions and have at least one direct deposit to hit your account. In addition, you'll need to sign up for electronic statements and sign in to online or mobile banking at least once each month. Complete all of these and you'll see an interest payment at the end of that month equivalent to 3.30% APY on your daily balance. However, miss just one requirement and you'll earn zero that month. Other software companies realized that there was potential to become the platform of choice for customers to do their banking.

Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems. Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature.

Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service. To come up with the best joint checking accounts, we compiled a list of the most popular choices and researched more than a dozen accounts. We considered banks that were entirely online and those that had brick-and-mortar locations.

We reviewed the monthly maintenance fees and minimum balance requirements, weeding out those with high fees or onerous minimums. We also assessed other important account features, such as the availability of free checks, ATM fee rebates, and Zelle payments. Checking accounts are bank accounts designed for frequent transactions, such as writing checks, making debit card purchases, paying bills, and sending money to other people. A joint checking account is simply one that allows for two account holders to share the funds and have access to the same account. View your mortgage account balance, payments, interest rate, and escrow information.

Use your home equity line of credit to transfer available credit to other Wells Fargo accounts, pay off outstanding balances, and pay bills. With a little shopping around and choosing an account that meets your expected banking behavior, you should be able to avoid almost all fees on a joint checking account. One set of options will be those accounts with no monthly maintenance fee and no minimum balance requirement.

Wells Fargo Everyday Checking is Wells Fargo's most popular account for day-to-day banking. While 1% is lower than the cash-back rate you'd receive with one of the best credit cards, it's great for debit cards, which typically don't offer rewards programs. Account holders have the ability to redeem cash back as a deposit into a Discover checking, savings or money market account or transfer it to their Discover credit card.

Opening a joint checking account with your tween or teen is an excellent way to help them learn how to bank wisely, as you track their account activity for teaching money moments. It's hard to beat Ally's Interest Checking Account, whose ease of couples account management and the ability to avoid almost all fees makes it our all-around winner among joint checking accounts. Established in 2009 as an internet-only bank, Ally also offers savings, money market, and CD accounts, as well as mortgages, auto and personal loans, and investment accounts. The best joint checking accounts offer features such as debit card usage, check-writing ability, ATM access, online bill payment, and more.

These accounts can easily be accessed by their account holders on the go and offer competitive interest and low or zero fees. Help stay in control of your account information with Wells Fargo Online. With online banking through Wells Fargo Online you can monitor your balances and activity set up alerts and view statements all from your smartphone tablet or desktop. And up to 7 years for deposit accounts home mortgage accounts and trust and managed.

Enter an invoice number or the serial number of the equipment being financed. After signing on you will see the Account Summary which includes your auto loan and all of your other Wells Fargo accounts. Applications In Progress Credit Card Rewards Small Business 401k Smart Data OnLine ClientLine. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made.

Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply.

If you're looking to minimize fees, you might want to consider an online checking account. Many of online checking accounts are interest bearing, have no monthly maintenance fees and have low rates for other fees. These accounts are ideal for individuals who don't need access to brick-and-mortar banking branches and who don't write checks frequently. You can open anaccount onlinewith SDCCU in just a few easy steps.

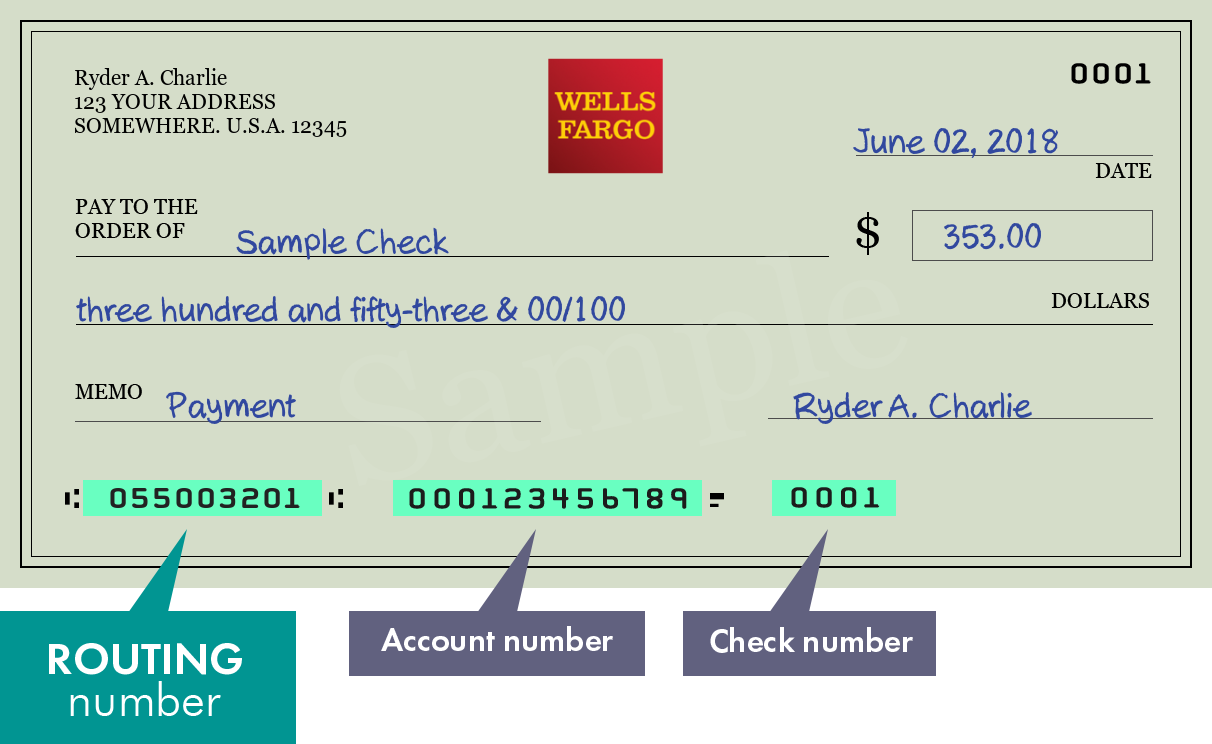

You can transfer funds from an existing SDCCU account, with your credit or debit card or from a checking or savings account at another financial institution. You'll just need your account number and the bank routing number of the bank account you are transferring from. But don't overlook the accounts that charge a monthly fee but make it easy to waive. For instance, if you can count on receiving at least one direct deposit paycheck every month, this will enable you to avoid monthly fees on many checking accounts. Similarly, if you're confident you can keep $500 or $1,000 in your joint checking account at all times, this will waive the monthly fee on another group of accounts.

Our overdraft fee for Consumer checking accounts is $35 per item ; our fee for returning items for non-sufficient funds is $35 per item. We charge no more than three overdraft and/or non-sufficient funds fees per business day. Overdraft and/or non-sufficient funds fees are not applicable to Clear Access Banking℠ The payment of transactions into overdraft is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is overdrawn or you have had excessive overdrafts.

You must promptly bring your account to a positive balance. Employees also created fraudulent checking and savings accounts, a process that sometimes involved the movement of money out of legitimate accounts. The creation of these additional products was made possible in part through a process known as "pinning". By setting the client's PIN to "0000", bankers were able to control client accounts and were able to enroll them in programs such as online banking.

Generally, we will attempt to withdraw the funds for your bill payment two times. You may be charged Overdraft Fees or Returned Item fees for each payment attempt and an Extended Overdraft Fee if your account remains overdrawn for five business days. Refer to the Schedule of Fees and Charges for your respective checking account for more fee information. Fees may be avoided by ensuring you have the available funds to cover your bill payments and any other outstanding transactions or by setting up Overdraft Protection. Then just enter the recipient's name, mobile phone number, email address or account number, the amount of the payment, your personal message and click Send.

With its Rewards Checking account, it makes it possible for checking account customers to earn between 1% cash back on their debit card transactions. When you make this a joint account and arm each account holder with their own debit card, the cash back rewards can really add up. Axos' generous ATM fee reimbursements are what earn it our top spot for couples with frequent ATM use, and the refunds are available with all of their checking accounts.

It features no monthly maintenance fee, no minimum balance, no ATM fees , and not even any overdraft fees. An added bonus is its Direct Deposit Express feature, which allows you to get your paycheck deposit up to two days early. Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards. The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service.

Account holders also have access to the Zelle peer-to-peer payment platform. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account.

Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions. If you send money to someone who isn't enrolled with Zelle, they will receive a payment notification prompting them to enroll with Zelle.

After your intended recipient enrolls, it may take between 1 and 3 business days for your recipient to receive that payment in their bank account. This is a security feature of Zelle designed to reduce risk and protect you whenever you're sending or receiving money. Once that payment completes, that recipient will be able to receive future payments faster, typically within minutes. Though it's a savings account, you have the ability to write checks from this account as long as you have the sufficient funds in the account.

You can also link this account to a regular Wells Fargo checking account for overdraft protection. We narrowed down our rankings by only considering checking accounts that charge no monthly maintenance fees . The Capital One 360 Checking Account takes the number-one spot on our list thanks in part to its top-rated mobile app, physical bank locations and an above-average APY. National Banking Satisfaction Study, which ranks bank customer experience across various factors, including deposit accounts and convenience.